Accident and theft insurance policies [abbr. in Polish: AC] constitute a specific product on the market of motor insurances. Their direct and fundamental aim is the protection of property against destruction, damage, loss and theft. It should first be noted that owners of vehicles are not legally obliged to purchase this kind of an insurance. Its voluntary character implies several consequences and perceivable dependencies. Firstly, the number of sold AC insurances may depend on e.g. the ratio between their price and the wealth of a given customer. Secondly, the age and actual cost of the vehicle constitute significant elements affecting the number of purchased AC insurance policies. The elder and less valuable is the vehicle, the smaller is a need to insure it. Thirdly and taking into account the above, it happens quite often that insurance companies offer AC policies as part of more comprehensive packages of similar products and suggest various package configurations.

Number of AC insurances on the market

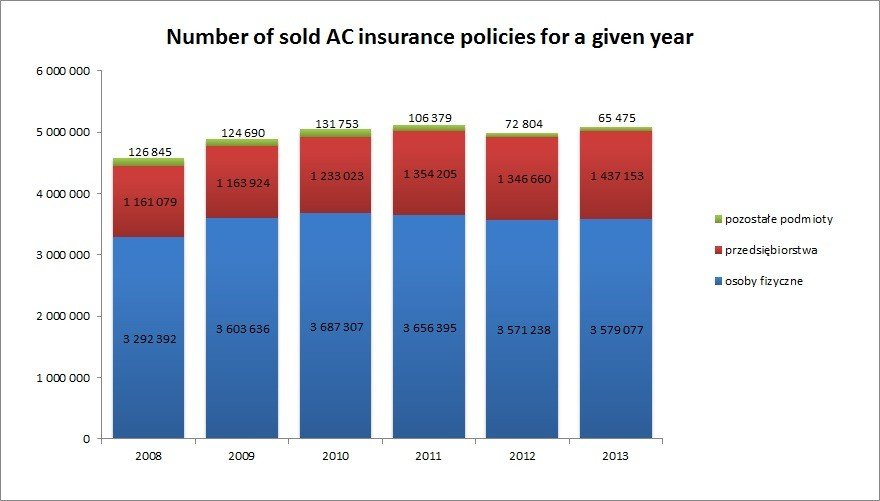

According to the recent data published by the Polish Financial Supervision Authority, in 2013 over 5 million AC insurance policies were sold in Poland. Comparing this data to 19,315,824 of purchased civil liability insurances, it might be concluded that averagely every fourth owner of a vehicle has both the mandatory liability insurance as well as the voluntary AC insurance. Detailed information for the last six years with a division into types of entities that purchase AC insurance policies are presented in the below chart. Within the period concerned, particular attention should be paid to the year 2011. It was the year when the largest number of AC insurance policies has been purchased (over 5.1 million). That year, however, is the last year of a continuous increase. When compared to 2008, the number of insurances has increased by 11.7%. Beginning from the ‘crisis’ year of 2012 (when a relatively high decrease in the number of purchased AC policies was observed – by 2.5% in comparison to the previous year), an upward trend is becoming apparent again. The division between entities, which purchase AC policies, is relatively stable and has been dominated by natural persons since several years.

Within the period concerned, particular attention should be paid to the year 2011. It was the year when the largest number of AC insurance policies has been purchased (over 5.1 million). That year, however, is the last year of a continuous increase. When compared to 2008, the number of insurances has increased by 11.7%. Beginning from the ‘crisis’ year of 2012 (when a relatively high decrease in the number of purchased AC policies was observed – by 2.5% in comparison to the previous year), an upward trend is becoming apparent again. The division between entities, which purchase AC policies, is relatively stable and has been dominated by natural persons since several years.

Gross written premium value ensuing from AC insurance policy

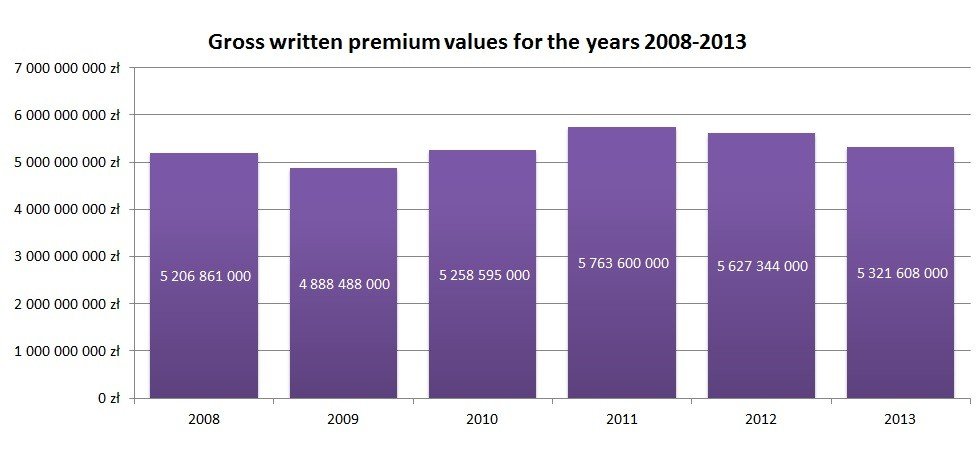

In 2013, income from sales of AC policies amounted to 5.3 billion Polish zloty. When compared with the year 2012, a decrease by 5.4% can be noted within that scope. Considering the ‘record’ year of 2011 (in total, sales of AC insurance policies amounted to about 5.8 billion Polish zloty), the decrease reached the level of 7.7%. The below chart illustrates precise gross written premium values for the years 2008-2013. When comparing the number of sold insurance policies to the above data, it can be concluded that average value of contribution per single insurance policy has been varying irregularly across the last seven years:

When comparing the number of sold insurance policies to the above data, it can be concluded that average value of contribution per single insurance policy has been varying irregularly across the last seven years:

- from PLN 999.23 (in 2009);

- through PLN 1047.21 (in 2013);

- to PLN 1136.79 (in 2008).

Damages and benefits from AC insurance policies

| Year | Gross amounts of damages and benefits from AC insurance policies

| Number of payments | Average value of a single payment of damages and benefits from AC policy |

| 2008 | PLN 3,113,704,000 | 646,120 | PLN 4,819.08 |

| 2009 | PLN 3,746,700,000 | 773,698 | PLN 4,842.59 |

| 2010 | PLN 3,859,807,000 | 844,091 | PLN 4,572.74 |

| 2011 | PLN 3,701,481,000 | 800,022 | PLN 4,626.72 |

| 2012 | PLN 3,440,257,000 | 706,476 | PLN 4,869.60 |

| 2013 | PLN 3,496,619,000 | 699,613 | PLN 4,997.93 |

The above table allows for a conclusion that insurance companies allotted almost 3.5 billion Polish zloty to payments of damages and benefits from AC insurance policies. When compared to six previous years, the sum seems to be following the average trend. It is lower by 9.4% than the maximum amount of 3.9 billion Polish zloty (in 2010), while at the same time higher by 12.3% than minimum value of 3.1 billion Polish zloty (in 2008). As far as the context of above data is concerned, it is worth paying attention to an interesting dependency. Although the average value of single payment from AC insurance policy has been systematically increasing since 2010, the number of payments is regularly decreasing.

Risks and profitability of operation within the market of AC insurance policies

Despite relatively high profits from sales of AC insurance policies, it is difficult to maintain profitability within the market of motor insurances. Moreover, conducting business activities within the sector implies greater risk. This is affected by several factors, which include primarily the difficulty to draw reliable estimates on the number of road accidents, while considering the extent of resulting damage. It is also worth mentioning about relatively high fluctuations in the purchase rate of new vehicles. Difficulties to estimate the number of potential customers, whom insurance companies would want to protect offering an AC policy, should also be observed.